Financial management is an extremely pivotal life skill that should be instilled from a young age. Knowing how to manage your finance has a positive impact on your life. The more financially independent we become, the more difficult it is to manage and track expenses. It causes one to be irresponsible and make unsound decisions in terms of finance.

In order to get a solid understanding of how I can intervene, I created a questionaire. The questions were as follows:

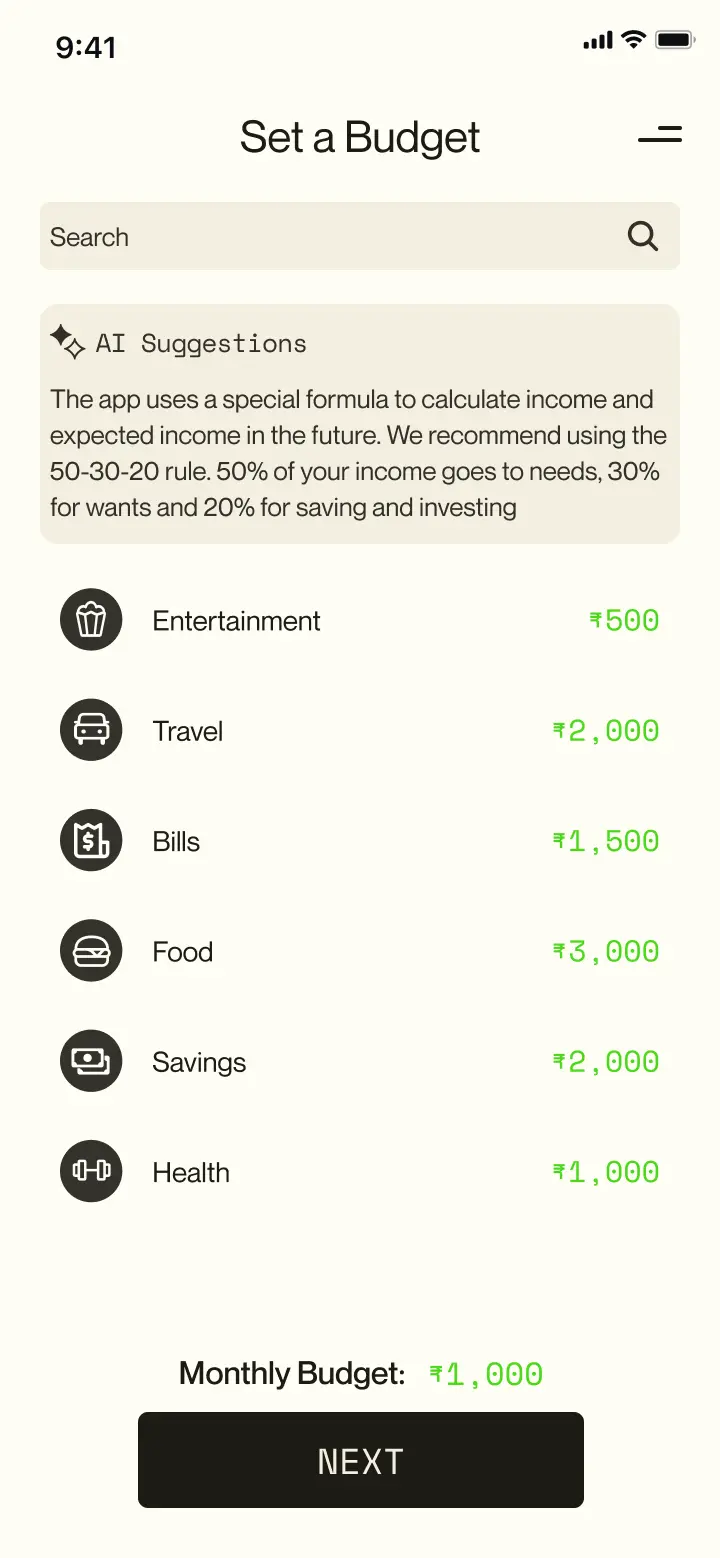

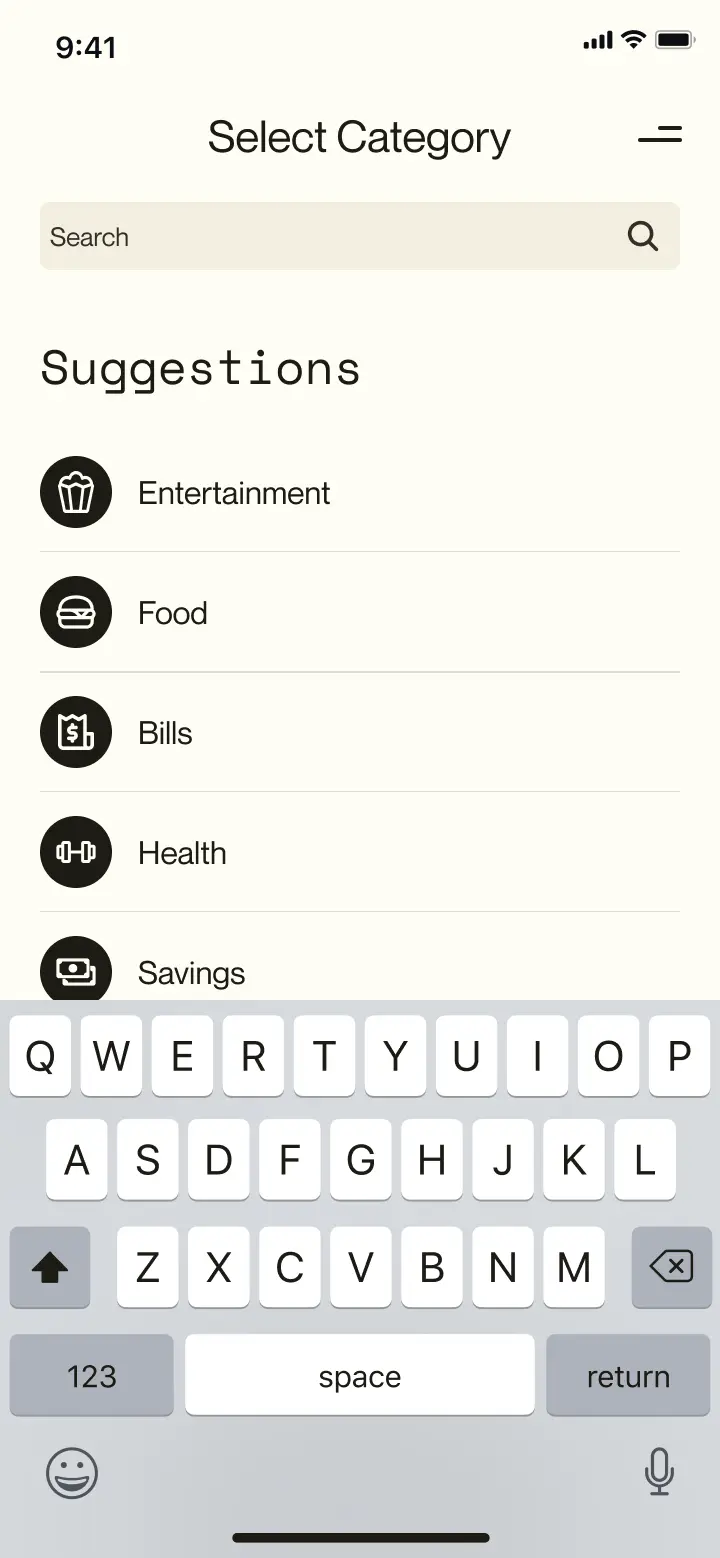

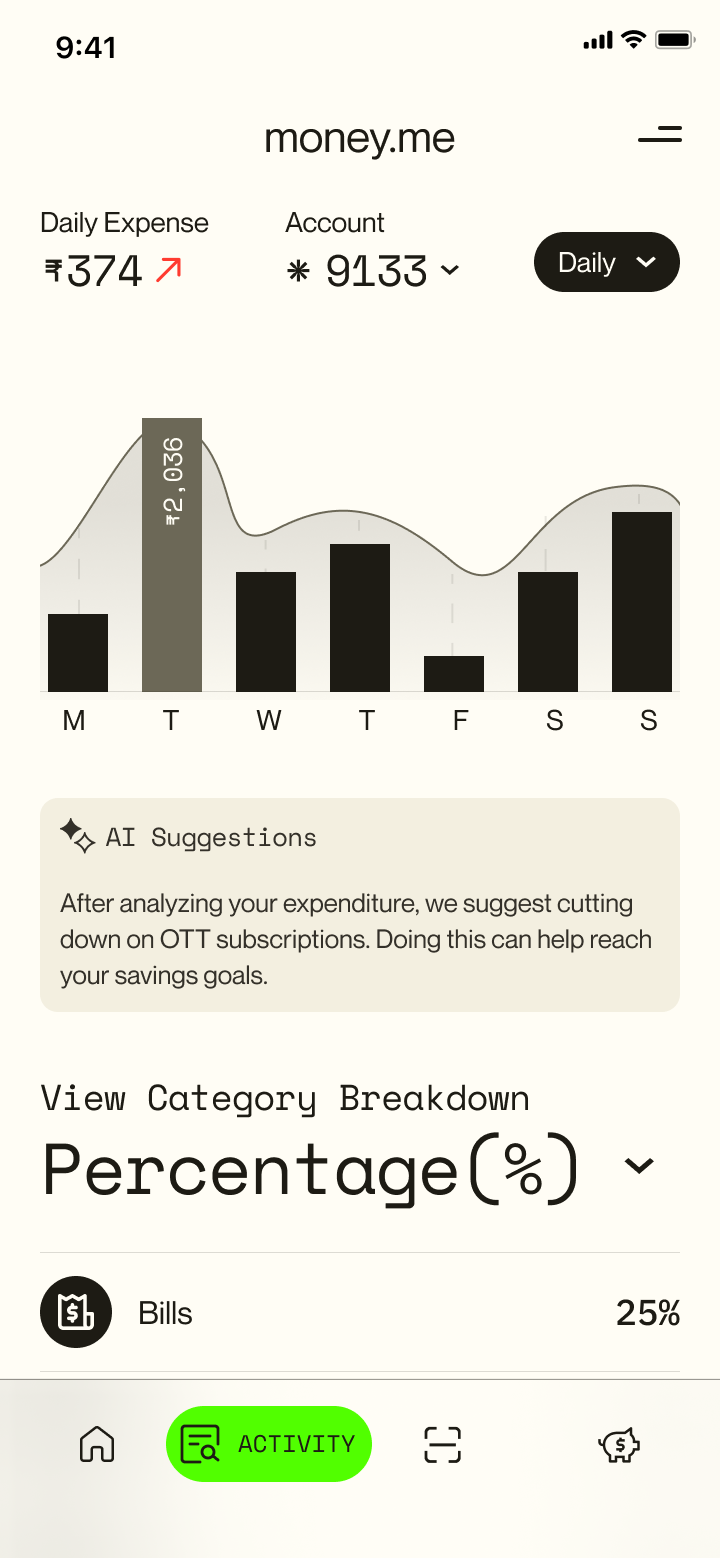

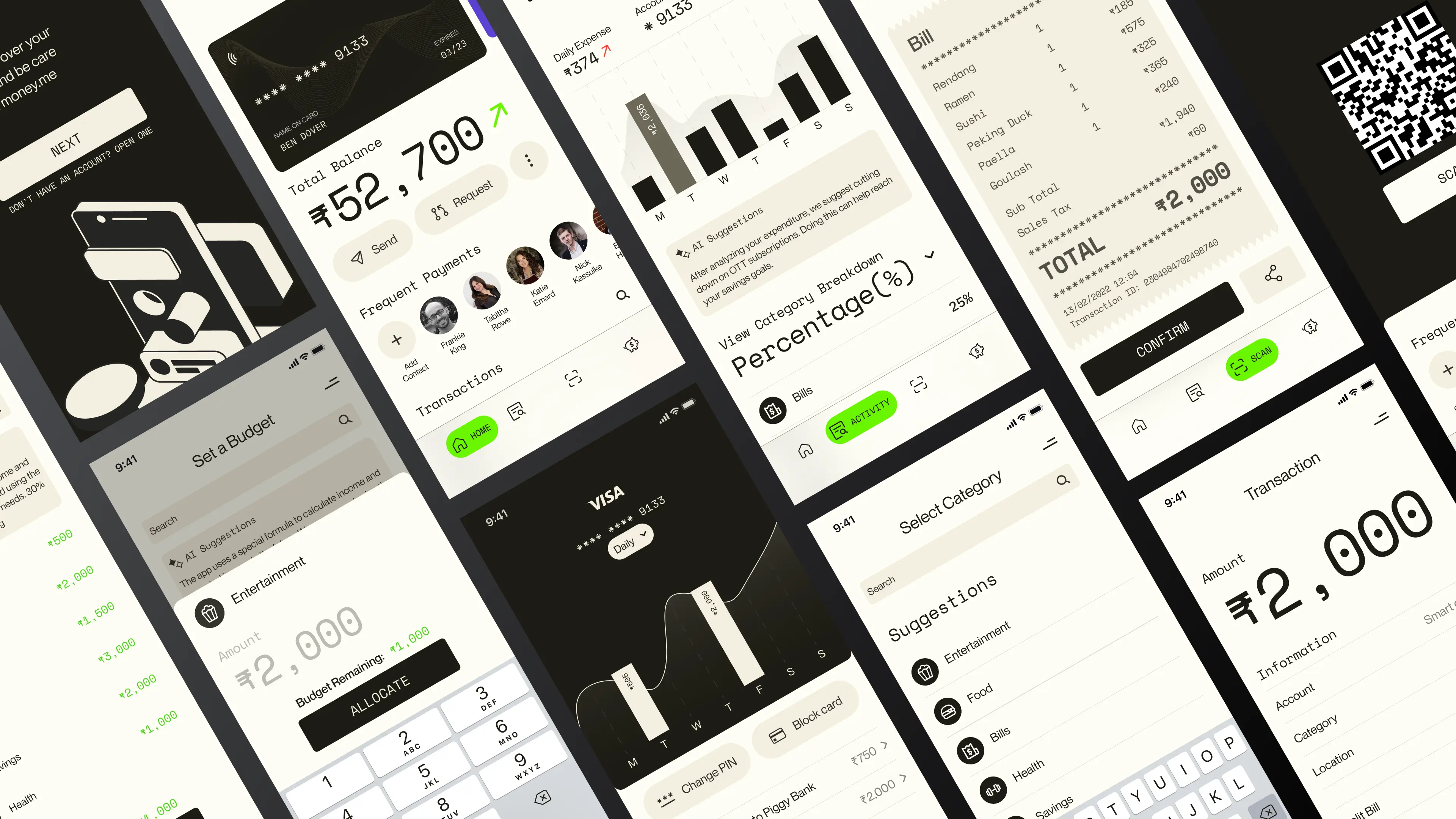

1. The app has no option for users to find out how much they spend on a specific item, such as food, and there is no search option for users to find out how much they spend on food this month.

2. The main function of the app is to enter income and expenses, but due to the poor user interface, it is unclear where to enter new income and expenses.

3. Not able to alert user properly regarding overspending.

4. People do not want to add another app in their repertoire to check all the time (create widget)

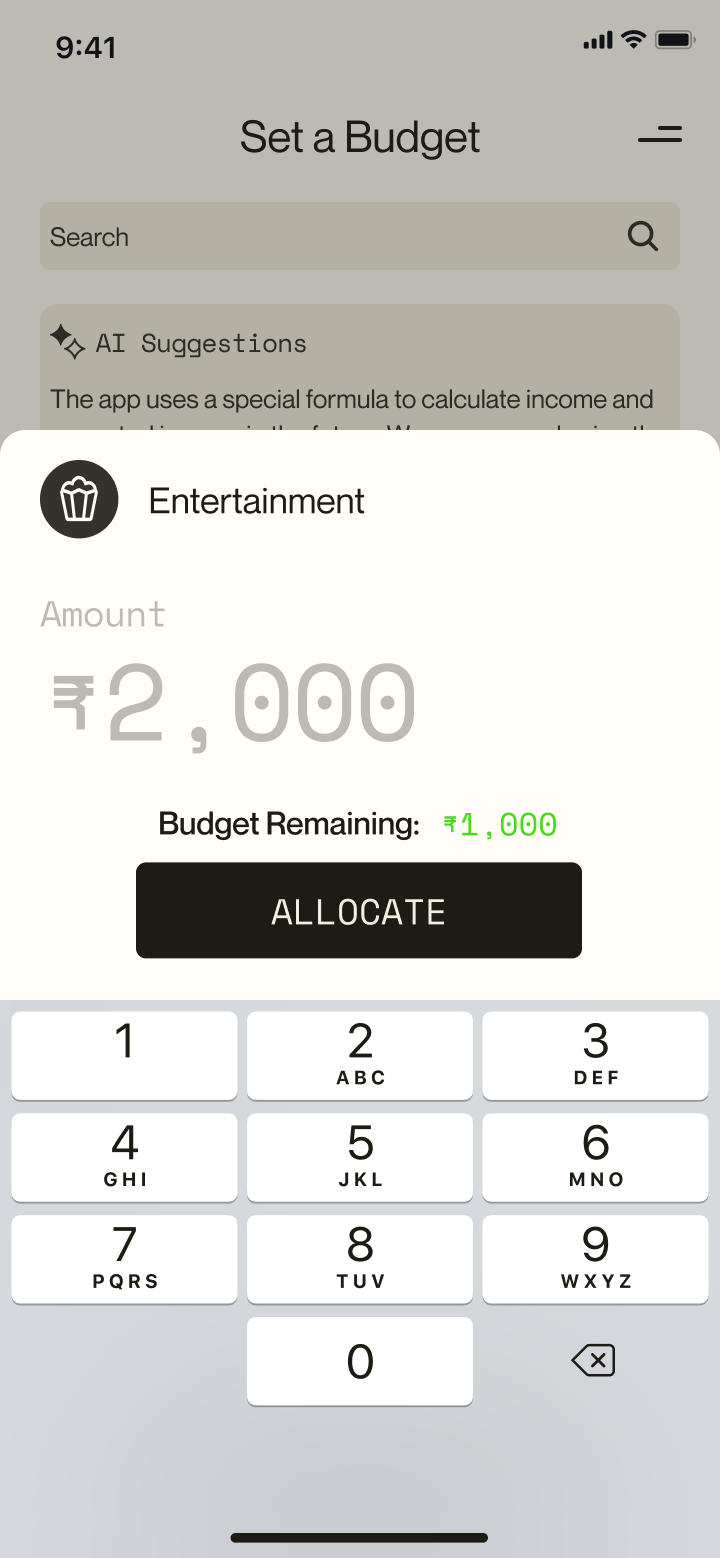

5. Inefficient categorizing

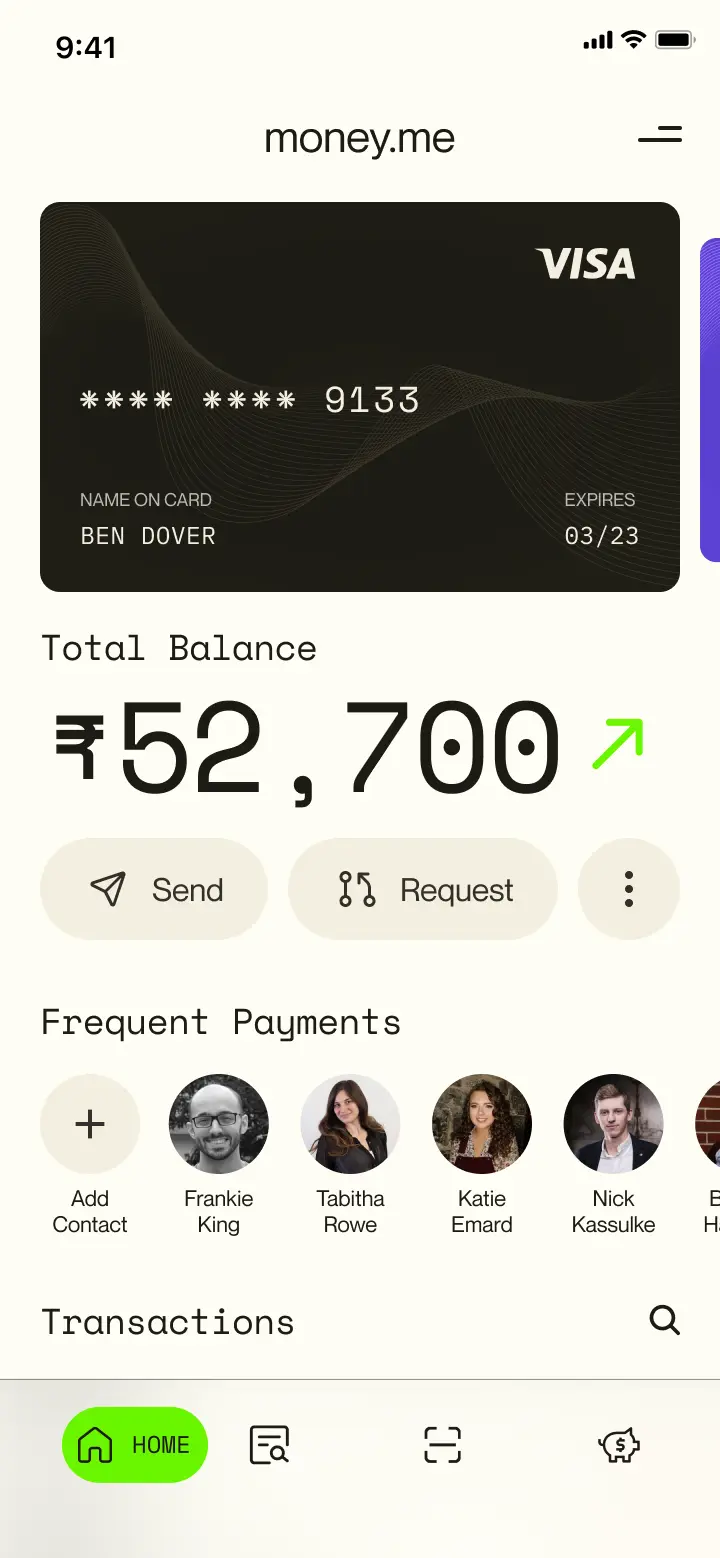

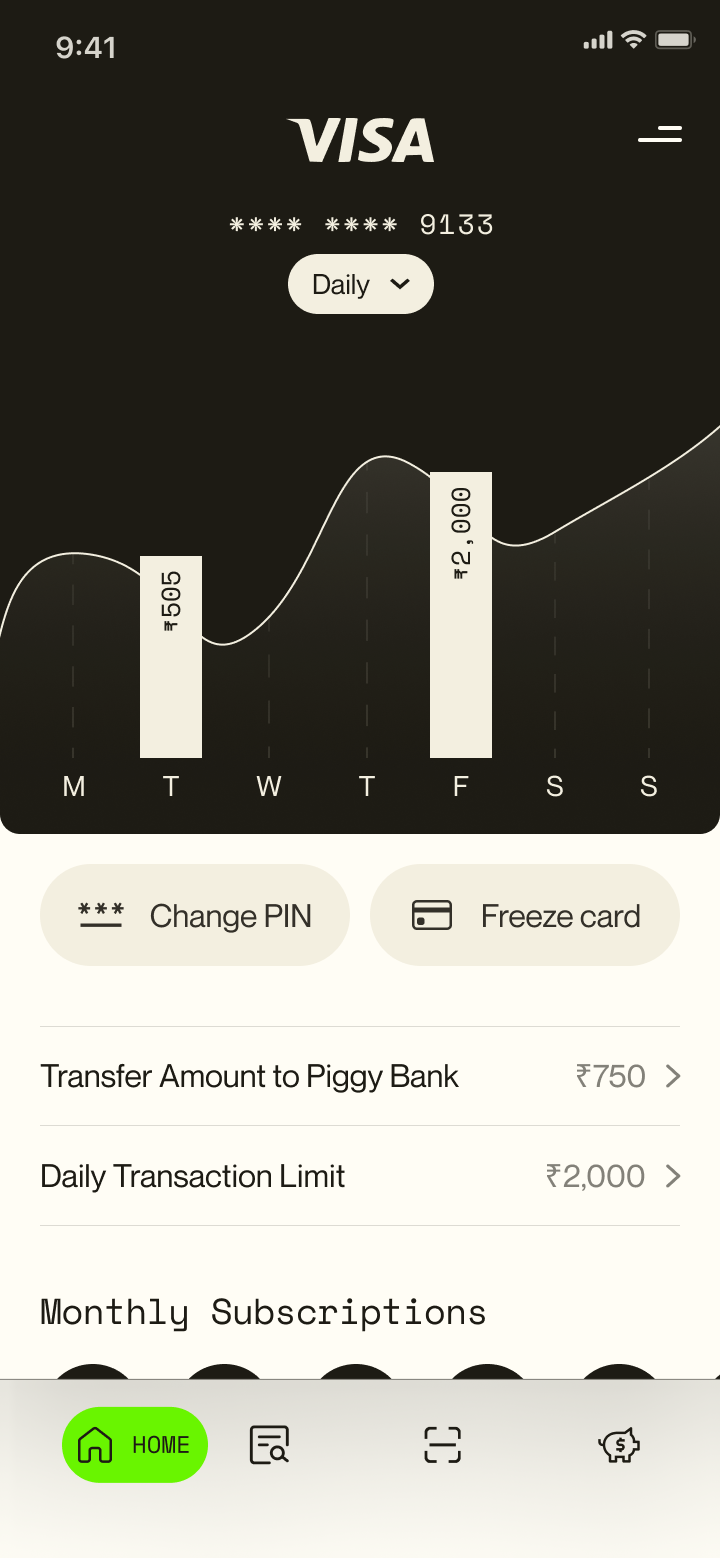

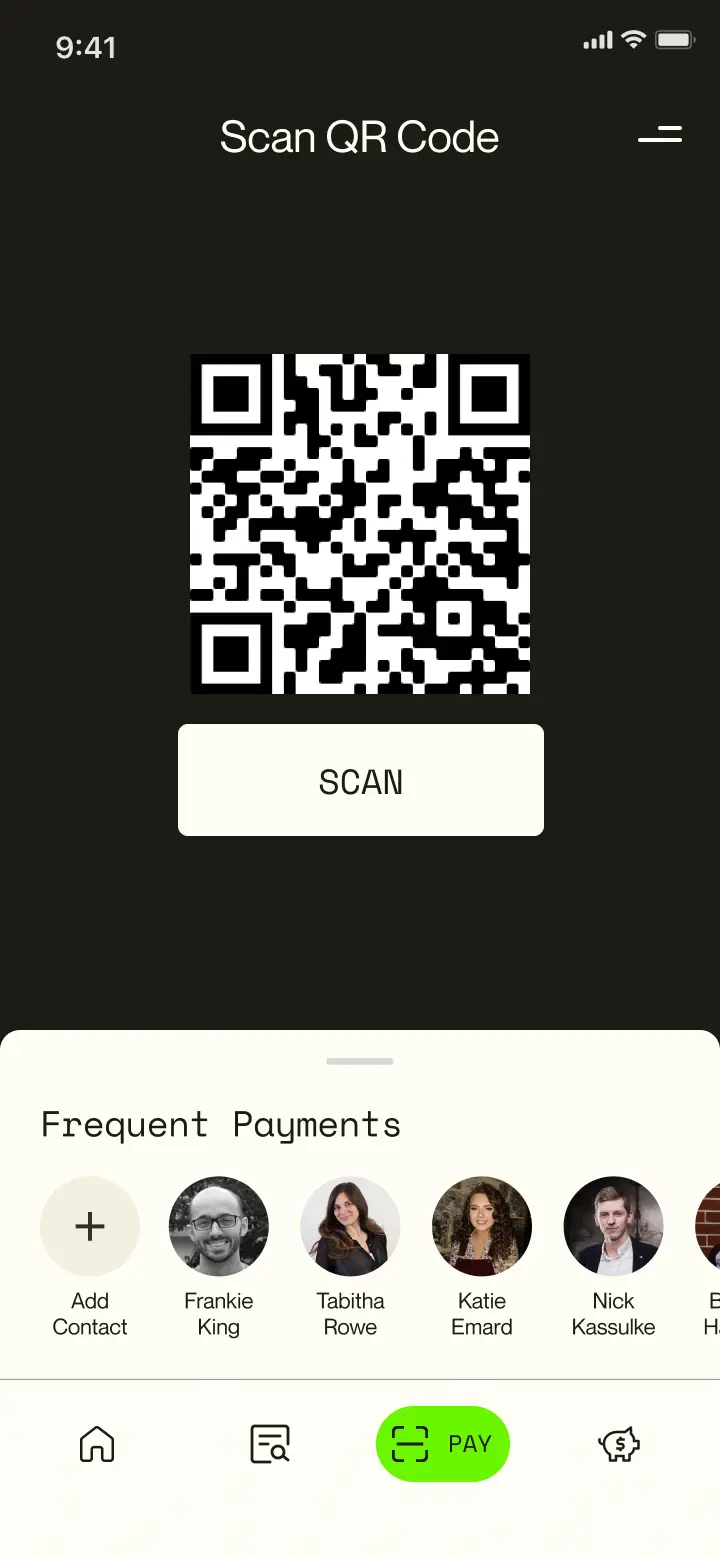

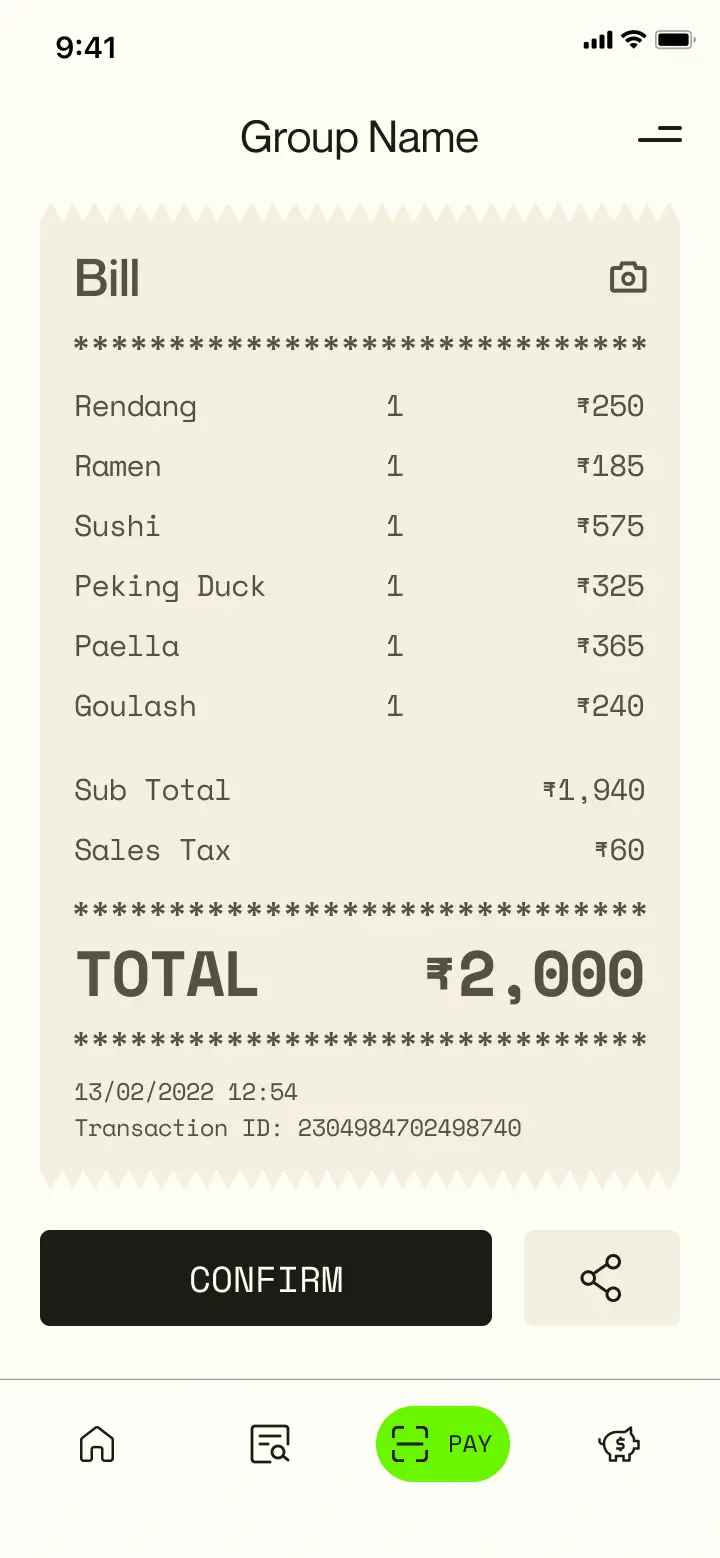

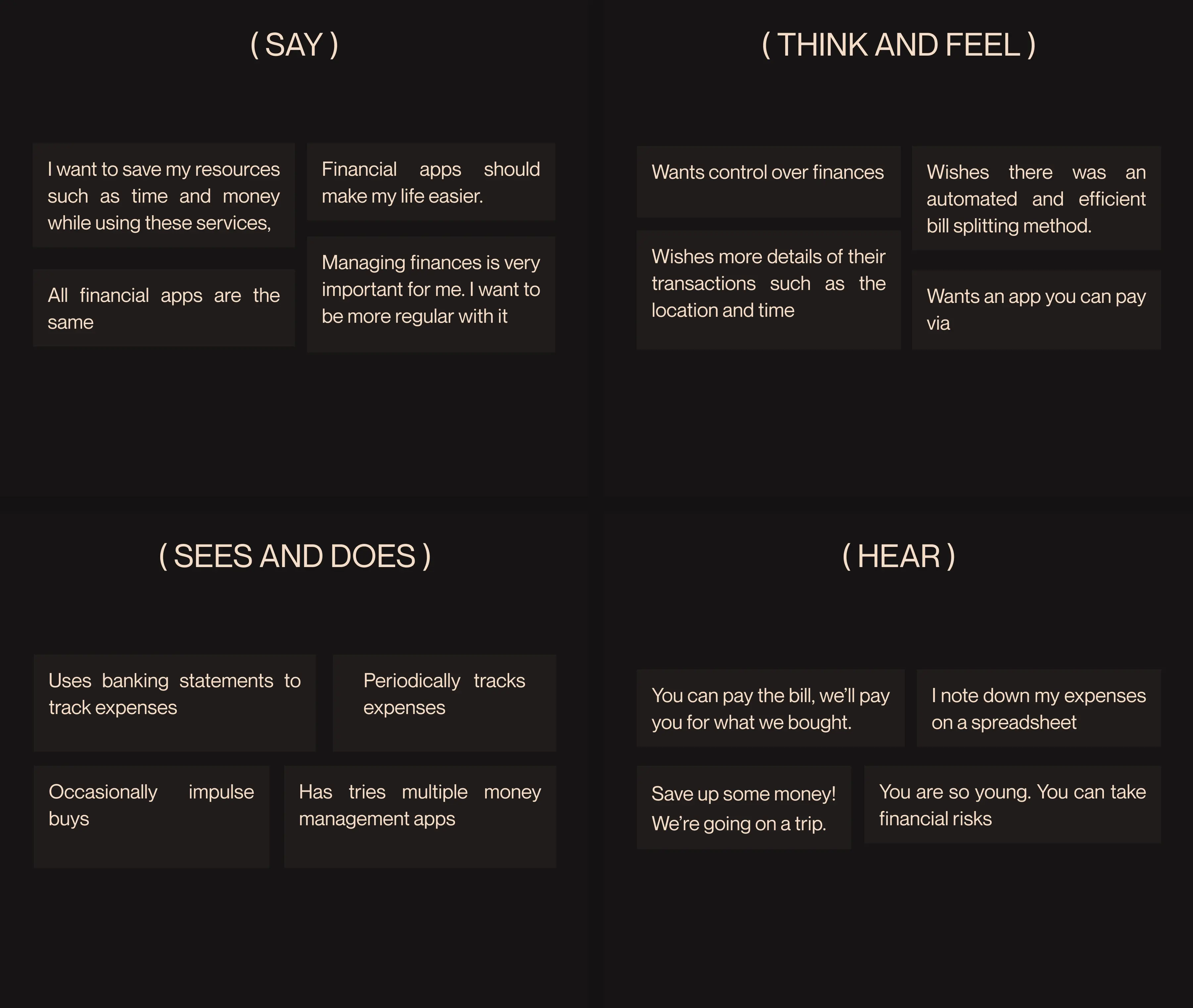

After understanding the user's needs, I could work on how my intervention helps the targetted demographic. For the app to be autonomous and require less effort from the user, I proposed using text messages received to the user's mobile device to retrieve accurate data. Another feature is an AI algorithm to notify users of their spending habits. The algorithm can inform the user of ways of cutting down certain costs to help save more. Saving money after cutting down costs can automatically be transferred to the 'Piggy Bank', which is set up by the user to be allocated in savings.